How Finance & Banking is Estimated to Lose $545 Million to Click Fraud

Jonathan Marciano

|Marketing | June 16, 2020

In the high-value and competitive industry of banking, finance, and fintech, Pay-per-click (PPC) is a crucial marketing component. A recent study by the University of Baltimore business School estimates that, for American finance businesses alone, over $3.6 billion will be spent on PPC advertising.

Companies purchase Pay-per-click (PPC) ads through contracts with online advertising platforms, under which businesses pay a certain amount of money for the number of clicks on PPC ads per day. However, of this paid spend by banks, it’s estimated that $545 million will be siphoned off by fraudsters through “click fraud” in the US alone. Click fraud is a well-known and growing challenge for banking marketing departments, targeting high-value and high-volume clicks. Finance businesses see around 15% of this spend lost due to invalid clicks or fraud. Finding a way to beat fraud is increasingly important to effective marketing before it causes long-term damage to brands and businesses.

What exactly is click fraud?

The act of click fraud is when your paid links are clicked on with the intent to either deplete or divert your marketing budget. It’s often carried out either by direct competitors or by organised criminals. The latter often have a complex infrastructure set up to defraud multiple businesses, usually through the use of fake websites and automated bots.

Most of the ad platforms refer to this problem as “invalid clicks”. This includes click fraud but also covers accidental clicks, automated activity such as web crawlers, and multiple clicks from the same source.

Which ad platforms does click fraud affect?

Although Google Ads is by far the biggest platform for PPC ads, it isn’t the only one that’s affected. In fact, click fraud is found in some form or another on most online advertising channels, including Facebook, Microsoft (aka Bing Ads), Instagram, LinkedIn, and Twitter.

Despite efforts from most of these platforms to block click fraud, or to put processes in place to make it much harder, the practice continues to grow for banks and financial services, sparked by the chaos of recent events such as COVID-19. Analysts have found that during the peak of the pandemic, financial industries were one of the worst hit by invalid clicks. During this time 25% of traffic on financial PPC ads were from fraudulent sources.

How click fraud affects big spending finance businesses

Fraudsters, as banks know only too well, follow the money. It is no different for ad fraudsters, who see the easy pickings of huge digital marketing spends as a simple way to drain budgets. This marketing spend can be vast. Five of the biggest US spend in the billions on marketing: JPMorgan Chase ($3.2 billion), American Express ($2.6 billion), Capital One ($2.1 billion), Bank of America ($1.5 billion), and Citibank ($1.4 billion).

Indeed, the average percentage of bank marketing budgets dedicated to Google AdWords is 1.9%, and for credit unions it is 7.4%. This is a large incentive for fraudsters to target with big guns spending tens of millions each month on PPC ads.

Those perpetrating click revel in digital advertising’s opaqueness and complexity, allowing them to hide signals in the noise. With credit card fraud, banks have limited amounts of requests, say 1 million a day to investigate. However, advertising fraud prevention solutions need to analyze 20,000 requests per second. Financial cybersecurity is famously first class, though protection for the bank’s marketing spend is decidedly less so, despite the current dangers.

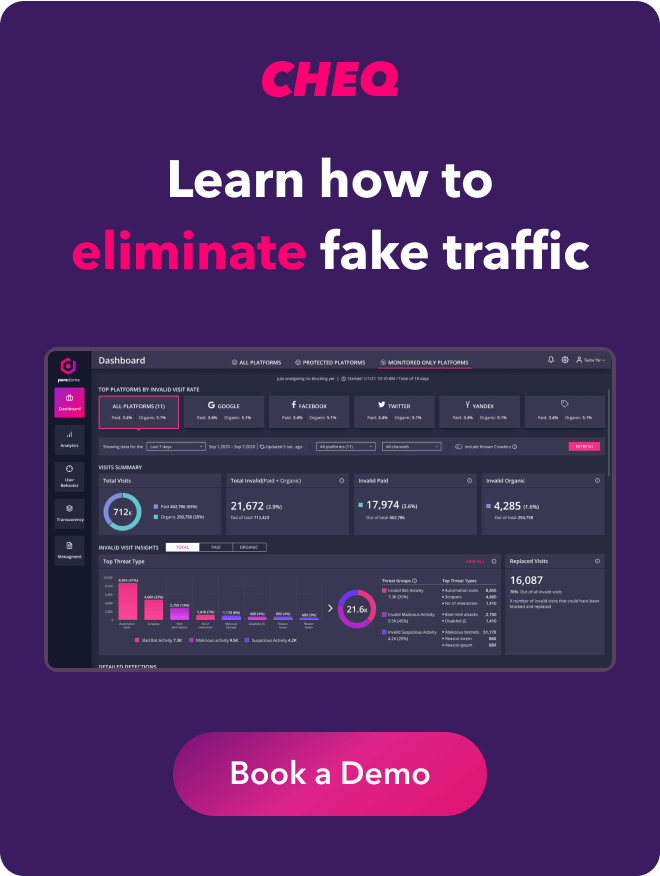

It is therefore not surprising that bank’s marketing departments have become a backchannel for fraudsters cashing out the bank’s ad budgets. The incentives are high and the chances of being caught are minimal: there have been almost no legal actions taken against ad fraudsters. Marketing departments do not have the same cyber defence to protect their budget deployed by the main bank’s operations. However modelled on the best cybersecurity protection, CHEQ for PPC provides the first cybersecurity-based protection for large enterprises, providing cybersecurity protection for ad fraud. This is addressing click fraud not just on Google Ads but all the biggest advertising platforms, including Facebook, LinkedIn, and Microsoft.

Using cybersecurity training for the first time in the world of advertising, CHEQ engineers built an engine that examines over 700 different user parameters in real-time, including Device/Browser/OS Fingerprinting and sophisticated honeypots (proprietary bot-traps). CHEQ developed AI to detect abnormal and fraudulent behaviour, comparing millions of events in real time.

Bigger losses for financial institutions beyond the fraud itself

The waste of money is not even the most damaging aspect of click fraud for banks and financial services. What is more damaging is the lost business as a result of these practices. With your ad knocked off the top spot, or your daily budget depleted, the lost visibility and potential business can be greater than the cost of a few clicks. This can affect the long-term brand and lead generation, with click fraud acting as a virus that seeps into your customer relationship management (CRM) bringing junk and bot leads, damaging sales, and wasting hours of executive team time. The problem of click fraud can also see your retargeting efforts diminished as ad campaigns simply throw more money at bad bots who clicked your ads. The infection is complete as bots and click fraud provide a skewed view of your customers, damaging banks’ ability to finetune ads.

Stopping click fraud in financial and banking marketing

The major ad platforms such as Google invest lots of time and money into stemming the tide of fraudulent practices. The problem is that resourceful fraudsters often find a way around their efforts.

So how can you stop click fraud on your PPC ads?

More and more businesses are turning to click fraud prevention software such as CHEQ For PPC. While most anti-click fraud software focuses on Google Ads, CHEQ covers all of the biggest advertising platforms including Facebook, LinkedIn, and Microsoft. This has been built by cybersecurity experts who are dedicated to preventing click fraud for large and enterprise companies.

The future of paid search and paid social in banking campaigns

Paid search and social media are the most important tools in any financial firm’s armory. In terms of ad spend by sector, financial services were set to grow the most in 2020, up 11.8% to $53.4 billion. Data from eMarketer shows that the financial services industry in the US accounts for 12.1% of total digital ad spend, behind only the retail and the automotive industries. But getting the best response from any ad campaign means being assured that you’re targeting genuine potential customers only.

Maximise the return on investment from your marketing and stop giving fraudsters your company’s money.

Find out about the fraud-blocking options available for all your search and display marketing with CHEQ.

Want to protect your sites and ads? Click here to Request a Demo.