The 8 Biggest affiliate marketing fraud cases

Jonathan Marciano

|Marketing | September 08, 2022

Marketers are lost approximately $1.4 billion in 2020 due to affiliate marketing fraud, according to a study by CHEQ and the University of Baltimore. This was part of a wider $23 billion ad fraud that occurs across various different advertising marketing channels.

Growth of affiliate marketing and related fraud

The growth of fraud has occurred concurrently with the growth of affiliate marketing. In fact, it has been estimated that up to 15% of all digital media industry revenue comes from affiliate marketing. For many companies, particularly in the travel and retail space, affiliate marketing has become their lifeblood, with brands offering big payouts, particularly for sales attributed to an affiliate partner.

However at least 9% of all transactions across mobile, desktop and app attribution are affected by fraud, from cookie stuffing to attribution fraud and typo squatting. Bad actors exploit shortcomings in tracking and attribution to claim online commissions unfairly, damaging both the digital advertising metrics, and ultimately bottom line, in online advertising campaign.

What is affiliate marketing fraud?

Affiliate fraud is any fraudulent activity undertaken in order to gain illegitimate commissions from an affiliate marketing program. Unscrupulous affiliates will attempt to take credit for as many referrals and purchases as possible, resulting in unearned and unnecessary commissions, polluted advertising channels, and wasted marketing budget.

Affiliate fraud can take many forms, but three of the most common are cookie stuffing, fake lead fraud, and chargeback fraud.

Cookie stuffing

When affiliate partners lead fake clicks and visits to your site in order to inflate their commissions and payouts and dilute your funnel.

Fake lead fraud

When affiliates use bots and fake users to fill out forms using stolen or illegitimate data, generating invalid leads in your pipeline and commissions for unscrupulous affiliates.

Chargeback fraud

When affiliates use bots with stolen credit card data to make fraudulent purchases to collect the commissions before the credit card theft is recognized and a chargeback is ordered.

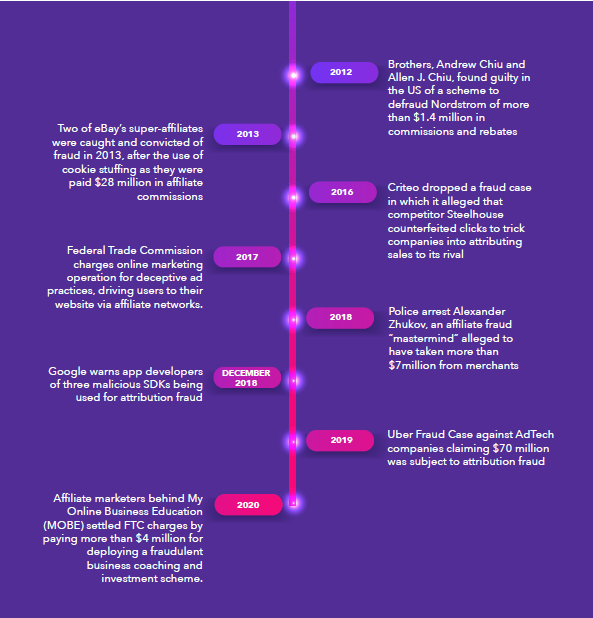

Eight high profile examples of affiliate fraud

Here are eight of the biggest affiliate marketing fraud cases you need to know, revealing the way affiliate fraud cases work.

1. Brothers, Andrew Chiu and Allen J. Chiu (2012) were found guilty in the US of a scheme to defraud Nordstrom of more than $1.4 million in commissions and rebates. According to the FBI, both men belong to FatWallet., a membership-based shopping community website promoting various online retailers by providing coupons and cash back incentives for purchases. FatWallet paid cash back rewards to the Chiu brothers for purchases made at various online retailers, including Nordstrom.com. In January 2010, the brothers discovered they could exploit a computer programming error in Nordstrom’s ordering system by placing orders that would ultimately be blocked by Nordstrom. The fraudulent ordering resulted in Nordstrom paying $1.4 million in rebates and commissions, with more than $650,000 in fraudulent cash back payments going directly to the brothers.

2. Two of eBay’s super-affiliates were caught and convicted of fraud (2013). Shawn Hogan, the CEO of a successful online marketing company called Digital Point Solutions, was sentenced to five months in federal prison for his role in defrauding eBay of an alleged $28 million in online marketing fees, in an elaborate cookie-stuffing scheme. eBay had even created an online sting operation, called “Trip Wire,” to monitor the traffic Hogan was sending. The sting also netted Brian Dunning, eBay’s second biggest affiliate marketer. The company had paid Hogan and Dunning a combined $35 million in commissions over the years, court papers say.

3. Criteo dropped a fraud case in which it alleged that competitor SteelHouse counterfeited clicks to trick companies into attributing sales to its rival (2016). In the end, both sides alleged the other was using dubious methods to artificially drive up their click rates. The case began when Criteo alleged it had lost business because SteelHouse used a “counterfeit click fraud” method to falsely take credit for user visits to retailers’ web pages. Many retailers measure the performance of their ad tech vendors by using a method called “last click attribution,” which gives credit to whichever computer served the last ad a user clicked on before landing on their websites.

4. The Federal Trade Commission charge an online marketing operation for deceptive ad practices, driving users to their website via affiliate networks (2017). The FTC charged the affiliate marketing operation with sending millions of consumers spam emails with links to fake news sites with fictitious articles and phony endorsements to sell weight-loss products.

5. Police arrested Alexander Zhukov, an affiliate fraud “mastermind” alleged to have taken more than $7million from merchants (2018). Prosecutors accused Zhukov of affiliate fraud. Lawyer in the case, Arkady Bukh said: “There is widespread fraud from huge amounts of traffic getting directed through botnets. Before, it was boys and girls in Russia sitting in boiler rooms clicking manual clicks in order to get apparent traffic to defraud affiliates,” he said. “Now it’s done by bots.”

6. Google warned app developers of malicious SDKs being used for attribution fraud (2018). Google took again against Cheetah Mobile’s File Manager and the Kika Keyboard on the Play Store. It was alleged they were among a rise in install attribution abuse falsely crediting app installs by creating false clicks. Google says: “We take reports of questionable activity very seriously. If an app violates our Google Play Developer policies, we take action. That’s why we began our own independent investigation after we received reports of apps on Google Play accused of conducting app install attribution abuse by falsely claiming credit for newly installed apps to collect the download bounty from that app’s developer.”

7. Uber Fraud Case against AdTech companies claiming $70 million was subject to attribution fraud (2019). Former Uber head of performance marketing, Kevin Frisch says following an investigation, he turned off $100 million out of $150 annual spend on mobile app installations to get new drivers. He says: “We basically saw no change in our number of rider app installs. What we found was that a number of installs we thought had come in through paid channels, suddenly came in through organic. I started gaining reports and I started seeing things that just did not make any sense. There is an app that has 1000 monthly active users and in theory we got 350,000 installs from them. We kept peeling this back, and we found that someone saw an ad and downloaded and opened the app within two seconds, which is just not possible. We discovered what we had was attribution fraud.”

8. Affiliate marketers behind My Online Business Education (MOBE) settled FTC charges by paying more than $4 million for deploying a fraudulent business coaching and investment scheme (2020). In March 2020, affiliate marketers behind My Online Business Education (MOBE) settled FTC charges by paying more than $4 million behind a fraudulent business coaching and investment scheme. Consumers paid as much as $60,000 for MOBE “mentoring” services. “These so-called ‘affiliates’ helped MOBE swindle consumers out of millions of dollars by making outlandish and false earnings claims,” said Andrew Smith, Director of the FTC’s Bureau of Consumer Protection.

Of course, the vast majority of affiliate fraud is never detected. When it is, they rarely end up with expensive court processes. Daily affiliate fraud occurs on a daily basis. As shown on our click fraud prevention platform, CHEQ for PPC protects advertising spending on all PPC platforms including Google, Microsoft, Facebook, and Twitter.

In the case of one travel website, spending $7 million a month on media suffered poor conversion rates. We found significant fraud by affiliates – driving 15% of traffic but the users were not converting.

In another case, a mid-sized US agency managing ad spend of $250,000 a month had affiliate sites that were being paid on a cost-per-click basis to drive traffic. Over 700 bots attempted to visit their site, 102 of them attempting to return over 400 times to the site. Naturally, none converted.

In another instance, a personal loans company in 2020, saw a 9.6% fraud rate coming from their affiliate channels. This affiliate fraud triggered a large volume of “loan reverses”. This sees the loan company approve loans based on a specified criterion, only then to cancel it as details turned out to be fake or fraudulent. This has seen affiliates place a massive exposure on the loan business which was forced to rip up loans of those likely default on their payments.

Defending your site from affiliate fraud

Affiliate fraud is a growing problem that compromises the integrity of your marketing program, wasting your budget on poor performing or outright fraudulent partners and presenting a massive opportunity cost by diverting funds from legitimate affiliate partners driving clean traffic.

CHEQ casts a light on all traffic from your affiliate partners, helping you block bad traffic and remove fraudulent affiliate partners who are driving fake clicks, leads and visits to your assets and helps you protect your bottom line and divert resources to high performing partners.