Affiliate Fraud: The Dark Side of Affiliate Marketing

Jonathan Marciano

|Marketing | August 07, 2020

Digital affiliate marketing is a performance-based approach to online marketing. It sees advertisers only pay when a sale occurs, involving online tracking that attributes sales to affiliates. Affiliates are third-party, independent websites, such as travel blogs, information pages and interest groups, who are willing to display advertisement links for a monetary gain. The payouts can be lucrative.

It has been estimated that up to 15% of all digital media industry’s revenue comes from affiliate marketing. For many companies, particularly in the travel and retail space affiliate marketing has become their lifeblood. Several brands are seeing 20% of their e-commerce revenues stemming from affiliate marketing, sometimes only months after launching their programs. It has extended to finance, loans and investments. For instance, eToro a social investment network has reportedly paid out $87 million in commissions to its affiliates since its inception. For Amazon 6% of its hefty 2.5 billion online visits a month arrive from affiliates, according to SimilarWeb.

Indeed, in a typical cyber Monday, about 16% of sales comes from affiliate traffic. This is drawn from 81% of advertisers that adopt affiliate marketing as part of their core marketing strategy, while, 84% of publishers adopt affiliate marketing.

Large prize for top affiliates

For those being paid by affiliate programs there is substantial money to be made. High-profile affiliate leaders include Pat Flynn, Smart Passive Income, who made over $100,000 in a single month, or Zach Johnson, who earns over $100,000 every year. In the world of sports gambling, Shahbazyan generates 25-40% lifetime commissions on net gaming revenues generated by referrals creating $2 million in U.S. dollars per year.

The Dark side of affiliate marketing fraud costing $1.4 billion in 2020

The problem occurs with bad actors exploiting shortcomings in tracking and attribution to claim commissions unfairly, damaging marketers and the bottom line of many businesses. In a study, CHEQ and the University of Baltimore have revealed that affiliate marketing fraud will cost advertisers $1.4 billion in 2020. Left unchecked the problem will continue to grow with global expansion of affiliate marketing into new markets and countries, particularly as the appeal of affiliate marketing continues to grow in a downturn during COVID-19.

Rates of fraud in affiliate marketing

The rates of fraud in affiliate marketing are highly debated. Indeed, it depends on the type of transaction – for instance up to 25% of app installs are considered to be fraudulent most often as a result of attribution fraud. Based on proprietary CHEQ data based on more than a trillion impressions, representing more than 39 sectors, and detailed interviews and insights from affiliate and marketing experts we consider the rate of fraud at 9% across affiliate marketing.

This is highly conservative estimate of fraud and many marketers report finding much larger percentages of fraud in their affiliate programs. Indeed, it was only four years ago that the University of Illinois estimated that 38.1% of partners in the Amazon affiliate program engaged in fraud.

Every day across our multiple CHEQ for PPC clients we see large rates of affiliate fraud contributing to a record rate of 14% invalid clicks across the paid search and paid social campaigns we protect across enterprises, agencies, and medium-sized businesses.

Loans company losing money due to affiliate fraud in campaigns

In one case in which CHEQ is investigating, a personal loans company is seeing a 9.6% fraud rate coming from their affiliate channels. Such affiliate fraud is triggering a large volume of “loan reverses”. This sees the loan company approve loans based on a specified criterion, only then to cancel it as details turned out to be fake or fraudulent. This has seen affiliates place a massive exposure on the loan business which was forced to rip up loans of those likely default on their payments. Protecting campaigns through click fraud software such as CHEQ for PPC prevents such fraud hurting your bottom line.

Methods of affiliate fraud

There are several methods of affiliate fraud that contribute to the $1.4 billion economic losses we expect by the end of 2020.

1. Cookie Stuffing

Browser cookies are the fundamental feature that enables tracking. Cookie stuffing is a process in which an affiliate will place many different cookies belonging to different advertisers (third-party cookies) in the visitor’s computer. If the visitor subsequently visits any of those advertisers’ sites and makes purchases, the affiliate will earn a commission without actually having taken part in leading the visitor to that site. In 2014, Shawn Hogan, the CEO of a successful online marketing company called Digital Point Solutions, was sentenced to five months in federal prison for his role in defrauding eBay of an alleged $28 million in online marketing fees in an elaborate cookie-stuffing scheme.

2. Attribution Fraud (app installs)

In the same vein, but for mobile apps, attribution fraud is a case where fraudsters attempt to steal credit for app installs, not generated by them. This is an attempt to register the last engagement before the app is first launched by the user. Attribution fraud tricks attribution platforms to associate an organic install or one created by another source to the fraudster, thus manipulating the “last-click-attribution” model commonly applied by attribution providers. For instance, in 2018 Google took again against Cheetah Mobile’s File Manager and the Kika Keyboard on the Play Store. It was alleged they were among a rise in install attribution abuse falsely crediting app installs by creating false clicks.

Uber suing for $70 million over attribution fraud

In one high-profile ongoing case ride-hailing company Uber says that it was duped out of more than $70 million through attribution fraud. Former Uber head of performance marketing, Kevin Frisch says following an investigation, he turned off $100 million out of $150 annual spend on mobile app installations to get new drivers. He says: “We basically saw no change in our number of rider app installs. What we found was that a number of installs we thought had come in through paid channels, suddenly came in through organic. I started gaining reports and I started seeing things that just did not make any sense. There is an app that has 1000 monthly active users and in theory we got 350,000 installs from them. We kept peeling this back, and we found that someone saw an ad and downloaded and opened the app within two seconds, which is just not possible. We discovered what we had was attribution fraud.” Such fraud may involve malware, in which a program “listens” to the user’s activity and is notified once a new app install starts. The malware will then search for campaigns relating to the relevant app, populating the relevant information into a fake click report, registering the last click engagement to win the attribution for an otherwise organic install or one generated by another media partner.

3. Typo squatting

In this tactic, affiliates register domain names that are misspellings of merchants’ domain names. (Moore and Edelman, 2010) When a user misspells a merchant’s domain name in the way that the affiliate anticipated, the user will be sent to the affiliate’s site, which immediately redirects the user through an affiliate link and onwards to the merchant. If the user makes a purchase, the affiliate will be credited.

4. Loyalty Software

Here, affiliates place “loyalty” software on a user’s computer to remind the user about possible rebates, points, or other benefits from purchasing through certain merchants.

The loyalty software automatically sends a user through an affiliate’s link when the user

requests a merchant’s site directly. Often, loyalty software claims affiliate commission even if the user had never registered with the loyalty service and is hence incapable of claiming or receiving benefits.

5. Deceptive affiliate marketing

Sometimes affiliates ads could be bait for a scam, according to investigations by the Federal Trade Commission (FTC). The FTC for instance cracked down on a low-cost trial scam placed by affiliate marketers. Here, a “free” trial offered up by affiliates ended up on a website that offered the product trial for $1.03. “That amount is not much, but it’s not free”, the FTC stated.” In fact, people who bought the trial for $1.03 ended up being charged almost $200 monthly for a second product they didn’t even want”. The FTC also continues to crackdown on schemes promising secrets behind making money on affiliate marketing. In March 2020, affiliate marketers behind My Online Business Education (MOBE) settled FTC charges by paying more than $4 million behind a fraudulent business coaching and investment scheme. Consumers paid as much as $60,000 for MOBE “mentoring” services. “These so-called ‘affiliates’ helped MOBE swindle consumers out of millions of dollars by making outlandish and false earnings claims,” said Andrew Smith, Director of the FTC’s Bureau of Consumer Protection.

In addition, fraudsters use variations on fake clicks and spamming to obtain credit for sales. A particularly nasty development is that of diverting. Diverting is the practice of diverting traffic from an affiliate’s site; when buyers are redirected to a fraudster’s site, they can still make a purchase, but the fraudster rather than the original affiliates receives the commission.

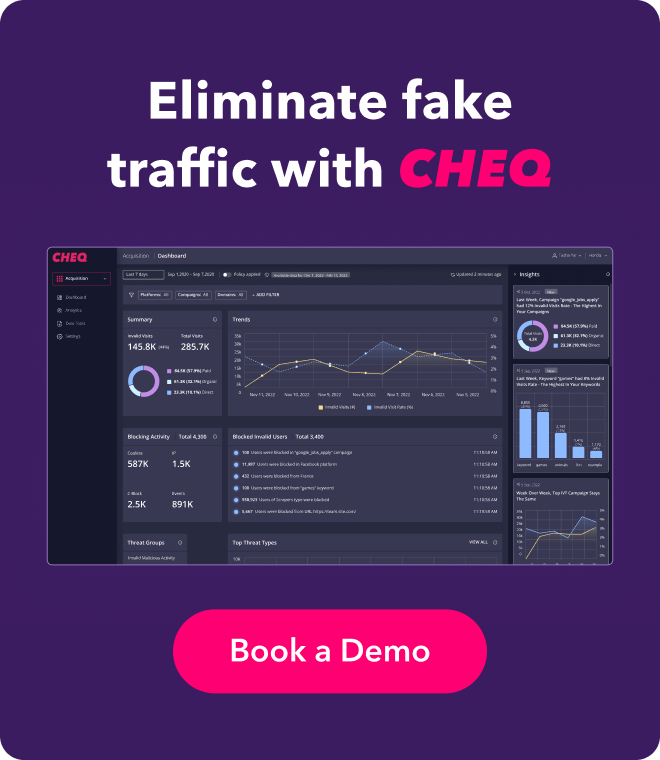

To protect your campaigns against invalid clicks, including affiliate fraud, check out CHEQ, which is the only solution that blocks invalid clicks across major PPC networks from Google to Facebook, LinkedIn, Instagram, Twitter, Bing, Pinterest, and more. The cybersecurity-driven solution blocks fraudulent and non-human users from clicking on ads, saving clients 10-15% of their ad spend, which is lost to invalid clicks.

P.S.

Want to protect your sites and ads? Click here to Request a Demo.